Page 218 - KWAP_Integrated-Report_2023

P. 218

ENRICHING NATIONAL PROGRESS ENRICHING SUStAINABLE REtURNS

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEAR ENDED 31 DECEMBER 2023

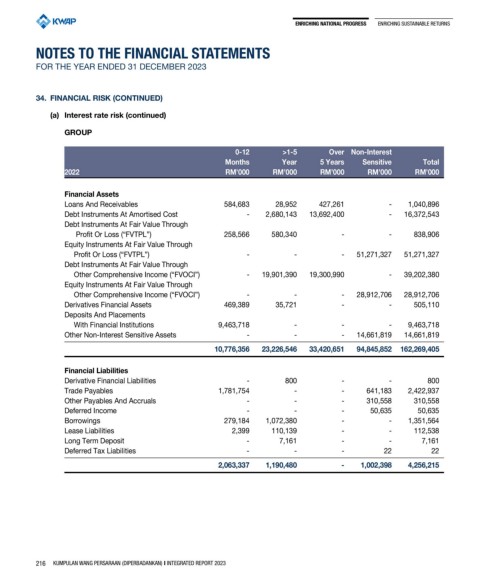

34. FINANCIAL RISK (CONTINUED)

(a) Interest rate risk (continued)

GROUP

0-12 >1-5 Over Non-Interest

Months Year 5 Years Sensitive Total

2022 RM’000 RM’000 RM’000 RM’000 RM’000

Financial Assets

loans and receivables 584,683 28,952 427,261 - 1,040,896

debt instruments at amortised cost - 2,680,143 13,692,400 - 16,372,543

debt instruments at fair Value through

profit or loss (“fVtpl”) 258,566 580,340 - - 838,906

equity instruments at fair Value through

profit or loss (“fVtpl”) - - - 51,271,327 51,271,327

debt instruments at fair Value through

other comprehensive income (“fVoci”) - 19,901,390 19,300,990 - 39,202,380

equity instruments at fair Value through

other comprehensive income (“fVoci”) - - - 28,912,706 28,912,706

derivatives financial assets 469,389 35,721 - - 505,110

deposits and placements

With financial institutions 9,463,718 - - - 9,463,718

other non-interest sensitive assets - - - 14,661,819 14,661,819

10,776,356 23,226,546 33,420,651 94,845,852 162,269,405

Financial Liabilities

derivative financial liabilities - 800 - - 800

trade payables 1,781,754 - - 641,183 2,422,937

other payables and accruals - - - 310,558 310,558

deferred income - - - 50,635 50,635

borrowings 279,184 1,072,380 - - 1,351,564

lease liabilities 2,399 110,139 - - 112,538

long term deposit - 7,161 - - 7,161

deferred tax liabilities - - - 22 22

2,063,337 1,190,480 - 1,002,398 4,256,215

216 KUMPULAN WANG PERSARAAN (DIPERBADANKAN) i INtEGRAtED REPoRt 2023