Page 233 - KWAP_AR2022

P. 233

FoR BetteR RetuRns Annual Report 2022 231

notes to the

financial statements

for the year ended 31 december 2022

33. FINANCIAL RISK (CONTINUED)

(d) Credit risk (continued)

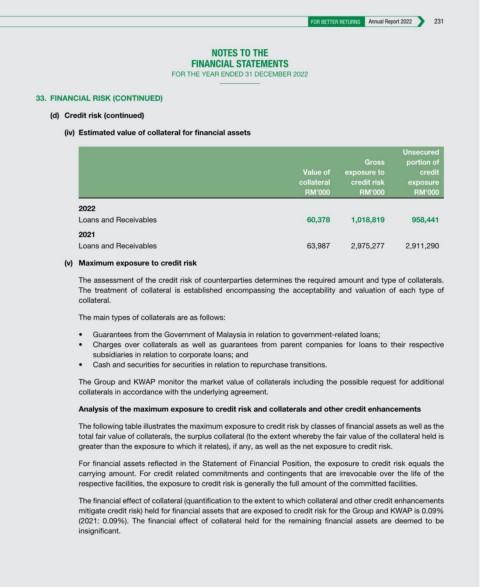

(iv) Estimated value of collateral for financial assets

Unsecured

Gross portion of

Value of exposure to credit

collateral credit risk exposure

RM’000 RM’000 RM’000

2022

loans and receivables 60,378 1,018,819 958,441

2021

loans and receivables 63,987 2,975,277 2,911,290

(v) Maximum exposure to credit risk

the assessment of the credit risk of counterparties determines the required amount and type of collaterals.

the treatment of collateral is established encompassing the acceptability and valuation of each type of

collateral.

the main types of collaterals are as follows:

• Guarantees from the Government of Malaysia in relation to government-related loans;

• Charges over collaterals as well as guarantees from parent companies for loans to their respective

subsidiaries in relation to corporate loans; and

• Cash and securities for securities in relation to repurchase transitions.

the group and KWap monitor the market value of collaterals including the possible request for additional

collaterals in accordance with the underlying agreement.

Analysis of the maximum exposure to credit risk and collaterals and other credit enhancements

the following table illustrates the maximum exposure to credit risk by classes of financial assets as well as the

total fair value of collaterals, the surplus collateral (to the extent whereby the fair value of the collateral held is

greater than the exposure to which it relates), if any, as well as the net exposure to credit risk.

for financial assets reflected in the statement of financial position, the exposure to credit risk equals the

carrying amount. for credit related commitments and contingents that are irrevocable over the life of the

respective facilities, the exposure to credit risk is generally the full amount of the committed facilities.

the financial effect of collateral (quantification to the extent to which collateral and other credit enhancements

mitigate credit risk) held for financial assets that are exposed to credit risk for the group and KWap is 0.09%

(2021: 0.09%). the financial effect of collateral held for the remaining financial assets are deemed to be

insignificant.